Lump Sum Election Worksheet

Get thousands of teacher-crafted activities that sync up with the school year. No Lump Sum Benefits worksheets are produced if you use the overrides.

Valentine Addition Subtraction 1st Grade Math Worksheets Kindergarten Addition Worksheets Kindergarten Math Worksheets Free

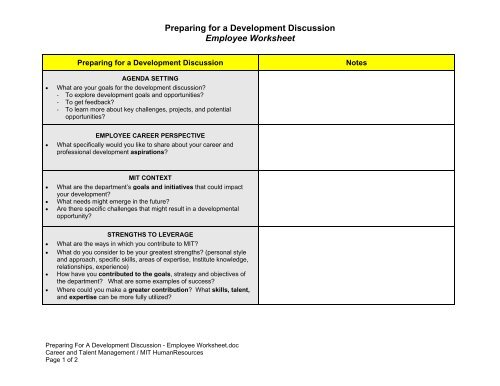

Discuss your plan to meet the deadlines.

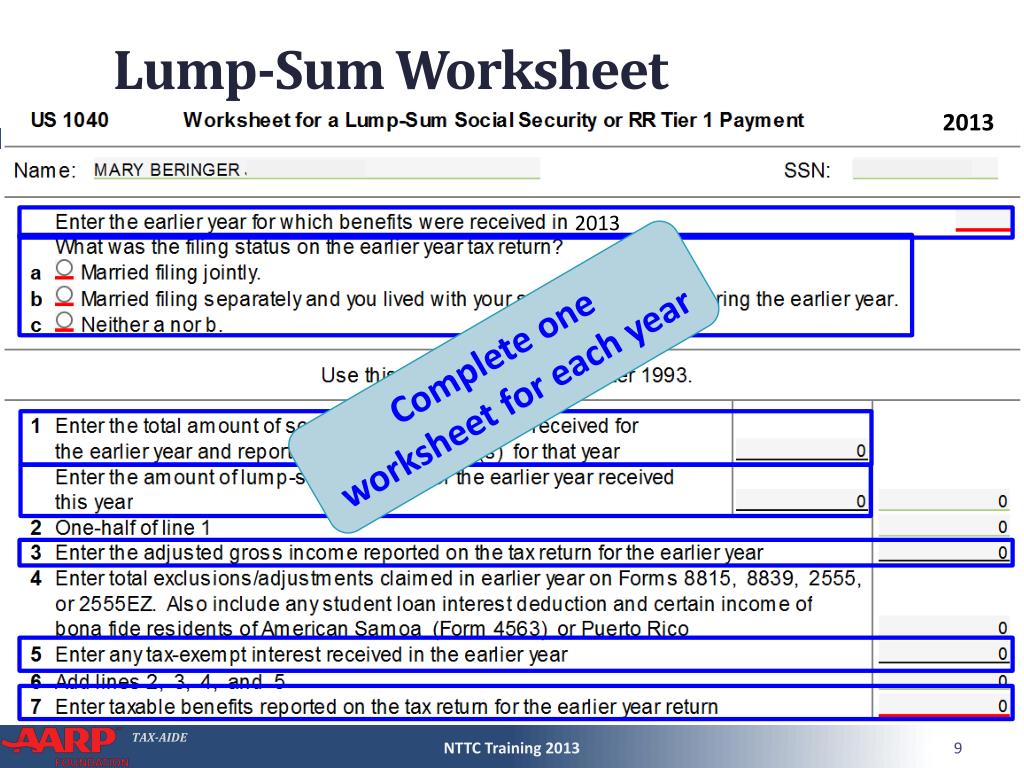

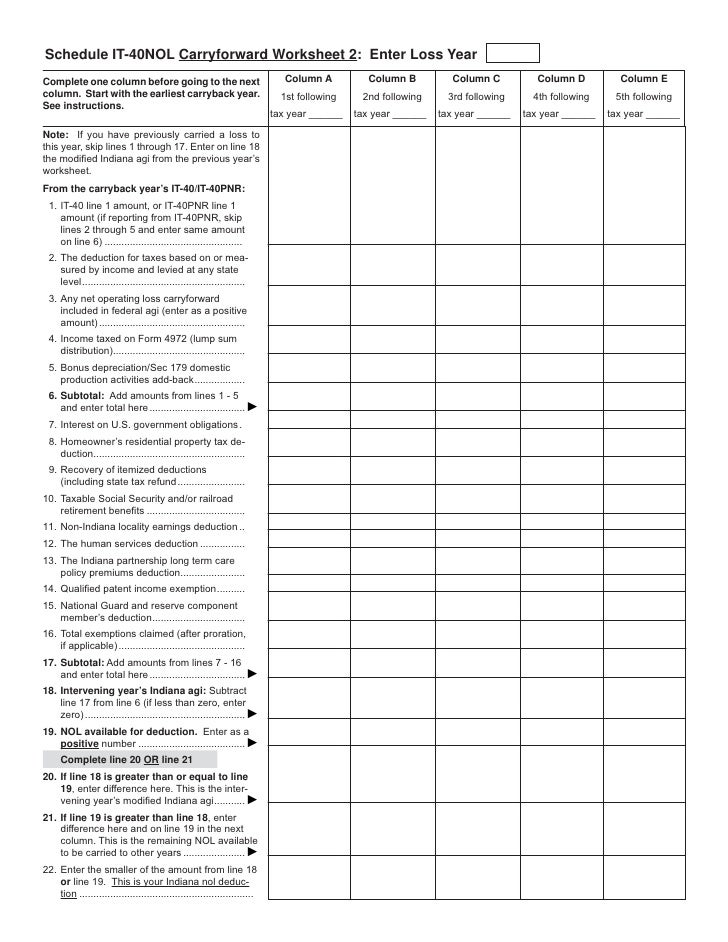

Lump sum election worksheet. Worksheet 2 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year After 1993 and Worksheet 4 Figure Your Taxable Benefits Under the Lump-Sum Election Method Use With Worksheet 2 or 3 are also supported. You received 20000 for the years 2018 and 2019. The Appendix at the end of this publication explains items shown on your Form SSA-1099 SSA-1042S RRB-1099 or RRB-1042S.

She completes Worksheet 2 to find the taxable part of the. Use Line 20 from federal Worksheet 4 if the taxpayer is electing to report taxable benefits under the lump-sum election method. To enter the amounts in the TaxAct Program which will transfer to IRS Form 1040.

Jane completes Worksheet 1 to find the amount of her taxable benefits for 2001 under the regular method. Depending on the taxpayers current year AGI this income may be taxable and should be reported on Form 1040. The term D stands for Married filing separately and did not live with the spouse.

She does not need to complete Worksheet 3 since her lump-sum payment was for years after 1993. Individual Tax Return. A lump sum Social Security payment is one that was paid in the current year as back pay for previous years.

Jane completes Worksheet 1 to find the amount of her taxable benefits for 2020 under the regular method. All information is required to correctly calculate the taxable income on your return. The purpose of this publication is to provide general information about personnel and payroll topics and is meant solely as a reference.

If box 3 of the 1099-SSA includes any lump-sum payment for an earlier year the taxpayer can use the lump sum election to refigure their taxable lump-sum payment for the previous year. Lump-Sum Election - Social Security. Get thousands of teacher-crafted activities that sync up with the school year.

Under the lump sum election method you refigure the taxable part of all your benefits for the earlier year including the lump sum payment using that years income. A lump sum Social Security payment is one that was paid in the current year as back pay for previous years. Review the Payroll Letter 20-021 as a team.

Review the updated Lump Sum Worksheet. To access the worksheet in TaxSlayer Pro Online select. Access to thousands of funds from leading fund managers.

If the amount on Wks SSB-4 line 21 is smaller than the amount on Wks SSB-1 line 19 then it will be used. Deductions related to your benefits including a de-duction or credit you can claim if your repayments are more than your gross benefits. Ad The most comprehensive library of free printable worksheets digital games for kids.

Lump-Sum Payments Begin Worksheet Each field and the information within are listed below. Then subtract any taxable benefits for that year that were previously reported. The term LSE means Lump Sum Election.

This is calculated from the Filing Status section of the Main Information Sheet. Ad Whether inheritance profit from a sale or a company bonus RL360 has solutions for you. However if the taxpayer cannot use the lump-sum election method the taxpayer must use Worksheet 1 in federal Publication 915.

How to treat lump-sum benefit payments. To see if the lump-sum election method results in lower taxable benefits she completes Worksheets 1 2 and 4 from this publication. The remainder is the taxable part of the lump sum payment.

Ad Whether inheritance profit from a sale or a company bonus RL360 has solutions for you. This is out of scope and should be referred to a professional preparer. What isnt covered in this publication.

This is calculated from the Form 1040 Worksheet 1 which is linked press F9 from line 20b of Form 1040. Worksheet 2 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year After 1993 and Worksheet 4 Figure Your Taxable Benefits Under the Lump-Sum Election Method are also supported. Year the lump sum payment was made for This will be the year in which part of your payment was for.

Access to thousands of funds from leading fund managers. The SSA Lump-Sum Payment Worksheet will help you determine if the lump-sum election is beneficial for the taxpayer but there is no need to complete the worksheet if the taxpayer has no taxable Social Security benefits. Up amount on the Election Form.

She doesnt need to complete Worksheet 3 because her lump-sum payment was for years after 1993. The repayment can be handled according to IRC 1341 as a Claim of Right in a manner similar to the SS Lump Sum Election. The LSE literal only prints when the lump sum election is of benefit to the taxpayer and is being used on the return.

To see if the lump-sum election method results in lower taxable benefits she completes Worksheets 1 2 and 4 from this publication. Ad The most comprehensive library of free printable worksheets digital games for kids. When looking at a taxpayers 1099-SSA box 3 shows the amount received in the current year.

Social Security Lump Sums are often associated with repayment of private disability insurance. Try the Lump Sum Pre-Tax Calculator. The amounts from these worksheets will transfer to Form 1040 US.

Social Problems And Solutions Worksheet Social Problem Problem And Solution Problem And Solution Worksheet

1040 Lump Sum Social Security Distributions

Publication 915 Social Security And Equivalent Railroad Retirement Benefits Lump Sum Election

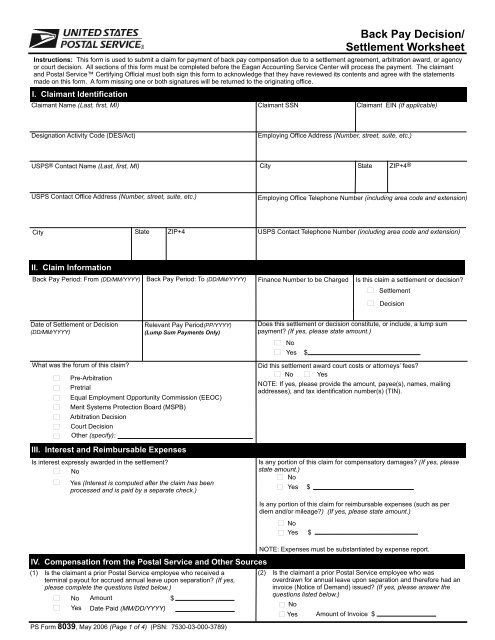

Back Pay Decision Settlement Worksheet Nalc Branch 78

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Other Deductions Worksheet Ode Ps Help Tax Australia 2020 Myob Help Centre

Investment Tracking Template Investing Savings Calculator Spreadsheet Template

Jon Wittwer Vertex42 Twitter Investing Savings Calculator Spreadsheet Template

Ppt Social Security And Railroad Retirement Equivalent Powerpoint Presentation Id 5597105

Publication 915 Social Security And Equivalent Railroad Retirement Benefits Deductions Related To Your Benefits

Foreign Pensions And Annuities Fpa Ps Help Tax Australia 2020 Myob Help Centre

Publication 915 Social Security And Equivalent Railroad Retirement Benefits Lump Sum Election

Publication 915 Social Security And Equivalent Railroad Retirement Benefits Deductions Related To Your Benefits

Preparing For A Development Discussion Employee Worksheet

Speedyhub Net Is Available For Purchase Sedo Com Girls Phone Numbers Things To Sell Reading Comprehension Worksheets

Publication 915 Social Security And Equivalent Railroad Retirement Benefits Lump Sum Election

0 comments:

Post a Comment